Riot Platforms

Grid Support

How Bitcoin Miners Provide Demand-side Energy Solutions

“ERCOT’s job is to balance generation and load and we can use load to provide that balance just as easy as we can use generation,” said ERCOT’s COO, Woody Rickerson.

Flexible Solutions to Manage the Demand and Supply Effectively

The Electric Reliability Council of Texas (ERCOT) is a nonprofit organization that ensures reliable electric service for 90 percent of the state of Texas, over 27 million customers. The grid operator is subject to oversight by the Public Utility Commission of Texas, which is appointed by the Governor.

Bitcoin Miners Are the Most Flexible Loads

Bitcoin miners, due to the network’s decentralized nature, can easily adjust power usage, unlike traditional data centers and manufacturers. Miners are the ideal consumer of new power generation because they provide a consistent, baseload customer during periods of low demand for power and also provide immediate, low-cost, demand-side flexibility during peak hours. Miner’s flexible consumption of power smooths out total demand on a grid because miners consume power when it is plentiful and do not consume power when it is scarce.

Bitcoin mining requires electricity, and miners typically secure power in two main ways: through the spot market or long-term Power Purchase Agreements (PPAs).

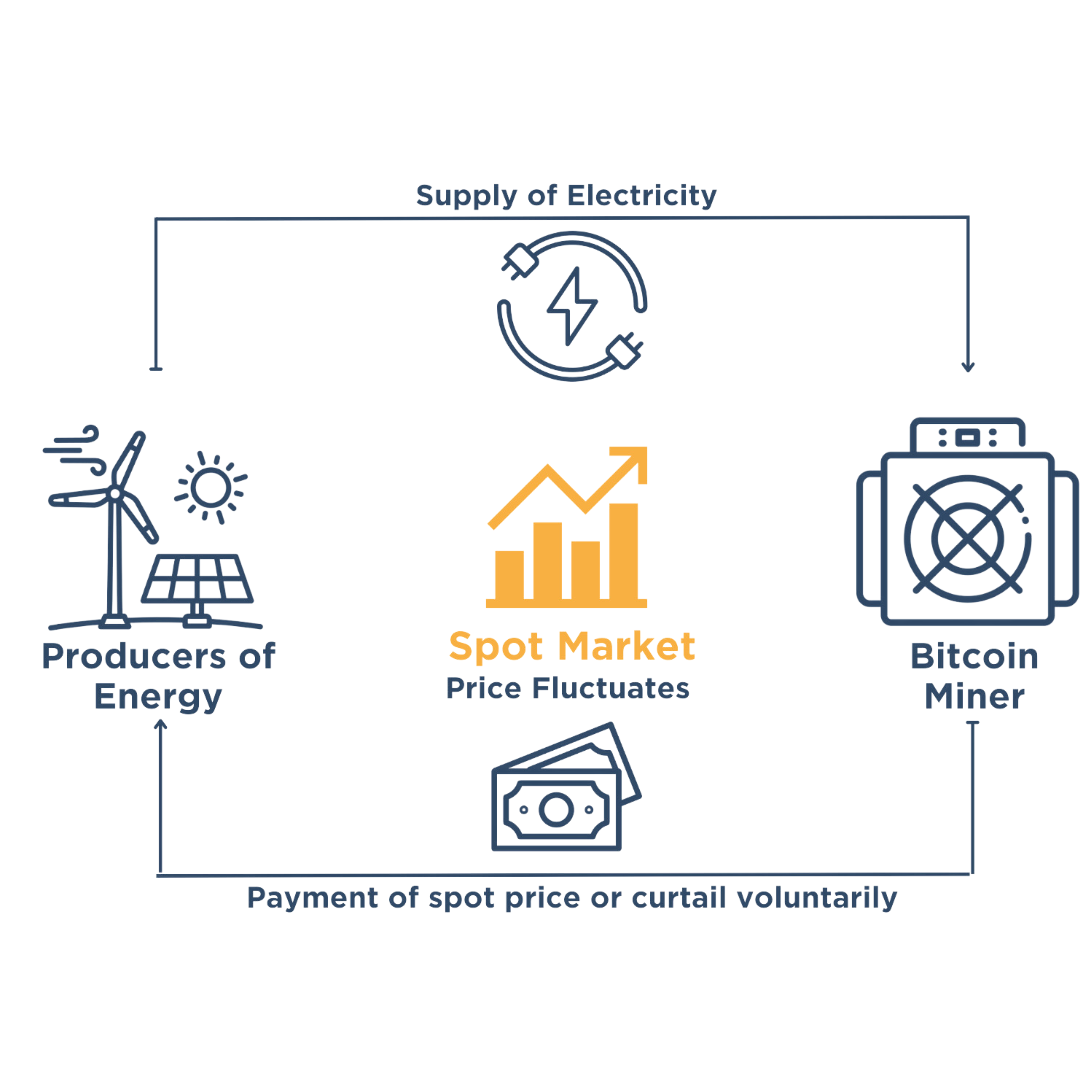

Spot Market Purchases

What is it?

- Miners pay the current market price for electricity.

- Prices fluctuate every 5 minutes based on demand and supply.

Curtailment

- Miners voluntarily shut down operations when electricity prices exceed the revenue from mining to avoid losses.

- Known as “economic curtailment” this near immediate response to price ensure miners do not consume power when demand is high and grid conditions are tight.

ERCOT’s Concerns

- Large generation sources or loads shutting off quickly can cause grid balancing issues.

- With visibility and predictability, however, ERCOT views bitcoin miners in particular as “quite useful” for maintaining balance and stability when demand rises and peak generation ramps up, or intermittent generation ramps down.

- Riot and other Bitcoin miners are registering in ERCOT’s Voluntary Curtailment Program to open direct lines of communication with ERCOT to ensure stability and prevent any potential disruptions in service on the grid.

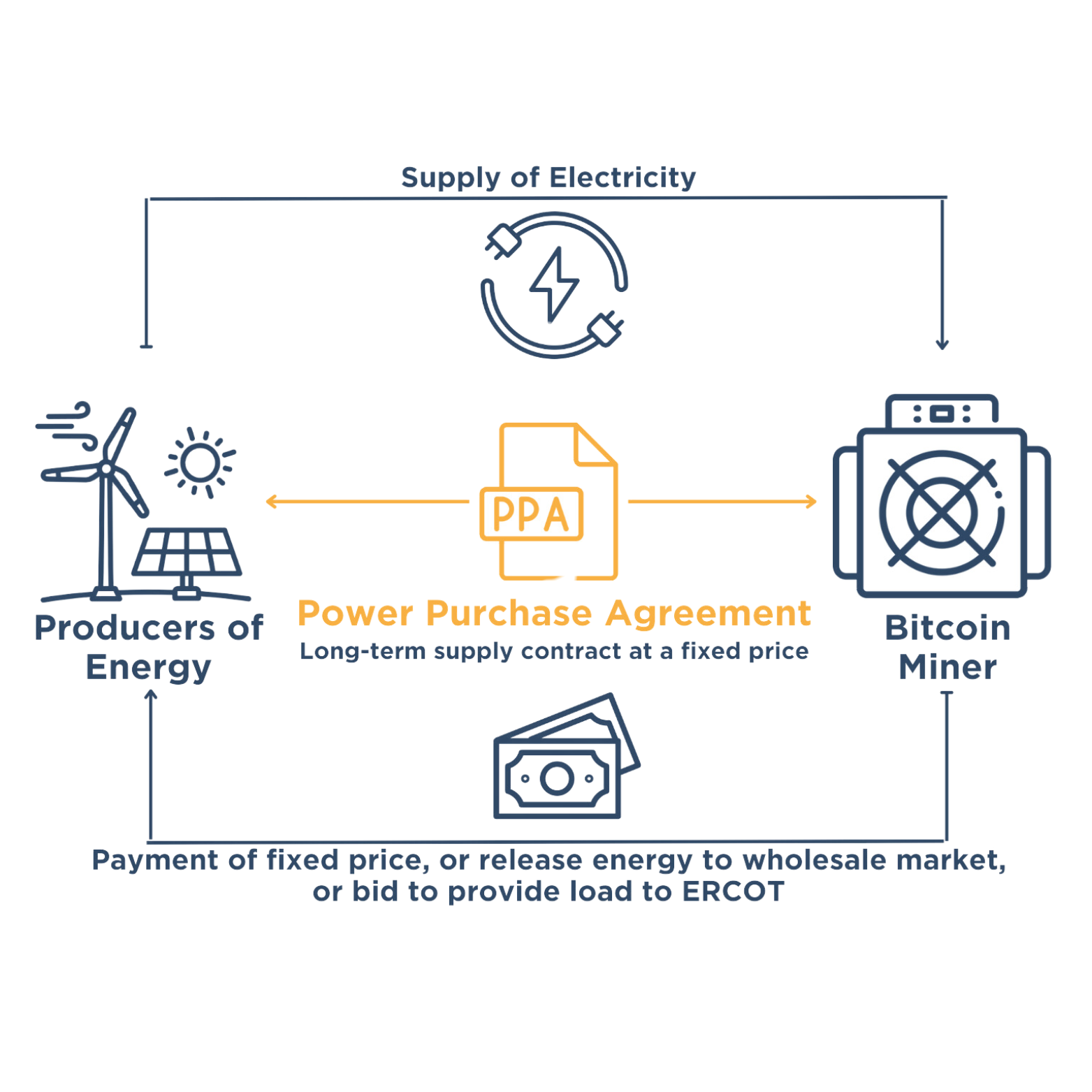

Long-term Purchase Power Agreements

What is it?

- Price for power under the agreement is based on the power generator’s expectation of future market conditions.

- Miners enter contracts for a steady, predetermined power rate over a long period.

- PPAs act as a hedge, providing price predictability similar to residential fixed-rate electricity plans.

- PPAs are competitively negotiated with power generation companies and cooperatives, not with ERCOT the grid operator.

Advantages to Miners

- Provides reliable power supply at a fixed rate, protecting against spikes in wholesale market prices.

- Can release pre-purchased electricity back to the wholesale market when prices for power exceed mining revenue.

- Predictable pricing gives confidence for miners to participate and bid into ERCOT Ancillary Services without taking on undue risk.

Advantages to the Grid

- ERCOT Ancillary Services are a set of resource reserves used by the grid operator. Through a competitive procurement process, reserves are created by paying generators to stay off and loads to stay on. These resources are obligated to be ready for deployment by ERCOT to achieve its reliability mandate.

- Makes new power generation projects possible by providing a guaranteed, long-term, consistent customer which reduces demand and price risk for the developer.

- Increased participation and competition in ERCOT Ancillary Services brings overall rates for these programs down.

ERCOT Security Constrained Economic Dispatch (SCED) and Controllable Load Resource (CLR) Programs

Security Constrained Economic Dispatch (SCED) is the real-time market evaluation of offers to produce a least-cost dispatch of online resources.

Controllable Load Resource (CLR) – A Load Resource capable of controllably reducing or increasing consumption under Dispatch control by ERCOT through SCED.

- For ERCOT to have the ability to directly dispatch BTC mining loads, the load must be in SCED. Currently CLR is the only path for a load to qualify to be in SCED.

- SCED allows ERCOT to manage demand and, to an extent, prices. Bitcoin miners’ flexible load is a lower-cost solution to deploy before more expensive generation or storage options are needed.

- ERCOT favors miners joining the SCED/CLR program for visibility and control.

- In SCED/CLR, ERCOT can modulate miners’ usage like a dimmer switch, maintaining balance even during high prices.

Challenges and Industry Collaboration

- A significant hurdle is patents, which leads to legal disputes for miners joining SCED/CLR.

- Resolving this is essential for smoother integration into ERCOT’s preferred system.

- Bills like SB 1751 could remove flexible, cost-effective loads, potentially increasing rates and reducing stability.

- Collaboration with ERCOT is crucial to transition more miners into SCED/CLR without negative market impacts.

Additional Insights

Interconnect Queue: The current interconnect queue is overestimated. Many potential power consumers are exploring power availability at multiple sites, but not all will proceed to fruition. ERCOT also models all loads as firm, instead of modeling BTC miners as flexible. Modeling BTC miners as flexible would correctly account for the load that can be adjusted or turned off as needed during times of high demand, and potentially decrease the amount of energy actually needed at peak demand.

Industry Commitment: Bitcoin mining is not a transient trend. Bitcoin is the world’s 10th largest asset, and a significant alternative to central bank digital currencies (CBDCs).

Economic Impact: Miners are significant employers and taxpayers across the state of Texas, contributing billions of dollars to local economies and supporting supply chain onshoring.

Company Profile: Contrary to misconceptions, leading Bitcoin miners are stable, transparent, and significant entities, such as Riot Platforms, a $3 billion American company.